Manage Rental Payments

To add or edit a rental payment for a lease:

-

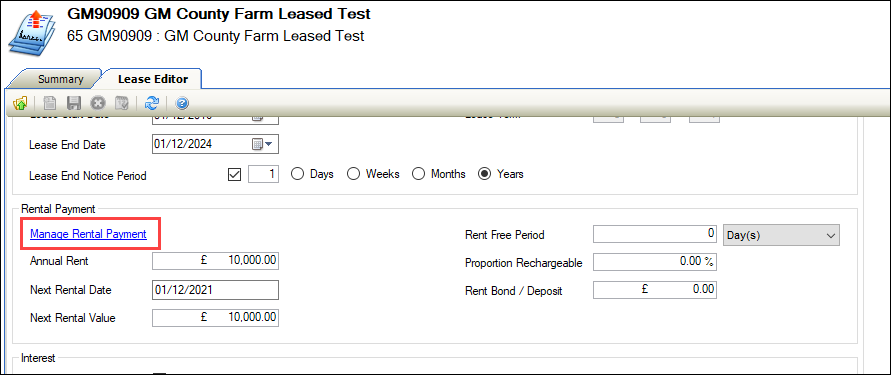

Search for and open the relevant lease record.

-

Click the Manage Rental Payment link in the Rental Payment section of the Lease Editor.

Note: This is only enabled if the lease record has been saved.

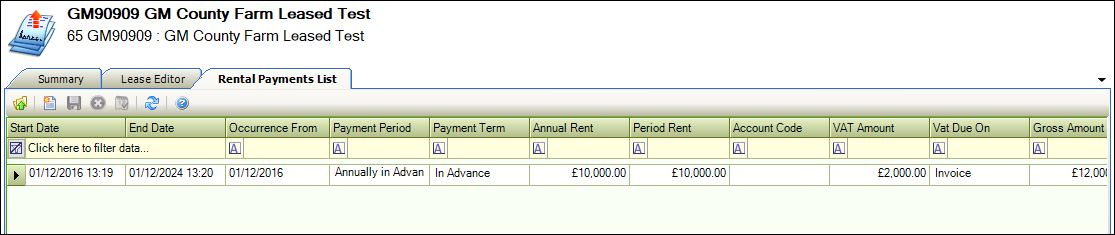

The Rental Payments List screen is displayed.

-

Click the New button to add a new payment.

Alternatively, double-click an existing record to open it.

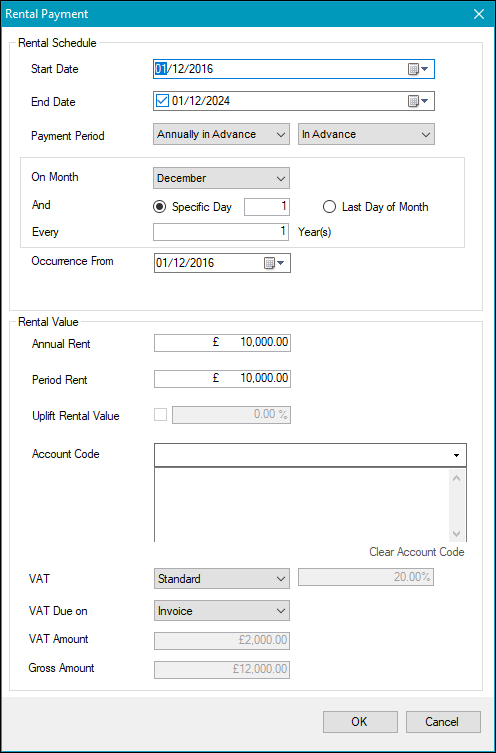

The Rental Payment window is displayed.

-

Enter or edit the relevant fields.

The fields on the are described in the following table.

| Section | This field | Holds this information... |

|---|---|---|

| Rental Schedule | Start Date | The rental start date. This defaults to the Lease Start Date from the lease record. |

| End Date | The rental end date. This defaults to the Lease End Date from the lease record. | |

| Payment Period |

The frequency of the rental payments. Note: These can be defined in Payment Period and Payment Term reference data (accessed by navigating to Functions > Core > Reference Data > Core). Additional payment fields are displayed and are dependent on the selected periods. Select the payment frequency from the relevant fields. |

|

| Occurrence From | The date from which the rent is to be collected. This allows you to select an initial rent-free period, if required. | |

| Rental Value | Annual Rent | The annual rental equivalent. Editing this field amends the Period Rent field. |

| Period Rent | The period rental equivalent. This is calculated based on the Annual Rent and the Period Payment fields. Editing this field amends the Annual Rent field. | |

| Uplift Rental Value | If a rental payment needs to be amended after a rent review, you can use this field to uplift the rent by selecting the check box and entering the percentage. Both positive and negative percentages can be entered. All the details of the previous rental payment will be displayed with the uplift automatically applied to the Rental Value fields. | |

| Account Code | The account code associated with the rental payment. | |

| VAT |

The VAT type. Note: These can be defined in VAT reference data (accessed by navigating to Functions > Core > Reference Data > Core). |

|

| VAT Due on | Whether the VAT is due on the invoice or receipt. | |

| VAT Amount | The amount of the VAT. This is calculated based on the Annual Rent and VAT fields. | |

| Gross Amount | The gross amount. This is calculated based on the Annual Rent and VAT Amount fields. |

-

Click OK.

At this point, only a lease Rental Payment schedule has been created. For the payment schedule to become a charge against the lease party, the ‘sp_GenerateCharges’ stored procedure needs to be run. This is usually set up to run automatically by Tribal but can also be run manually by the user by navigating to Estates > Estates > Generate Estates Charges. This checks all charges due within the period specified in the Generation Charge Period field on the General Tab in Financial Options (accessed by navigating to Tools > System Options and then clicking the Financial Options button).

If any rental payment charges specified in the schedule fall within the period specified, they will be visible against the Lease Party.